THANKS TO GAU, THE AVERAGE GRADUATE EMPLOYEE AT UF SAVES

DOLLARS PER ACADEMIC YEAR IN NON-TUITION STUDENT FEES!

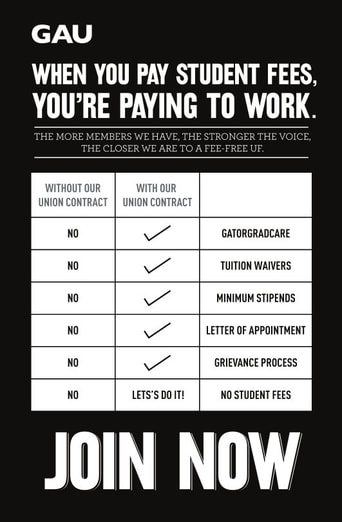

Fees force employees to “pay-to-work,” which is especially true of graduate employees who are no longer taking classes but only working on their research and teaching. Fees are also a way to get around the full tuition waiver that our contract guarantees to all graduate employees! The University cannot charge us tuition, so they charge us fees instead. The same argument has been made by the Florida Board of Governors, the body that oversees the operations of the State University system.

To make matters worse, there is very little transparency about HOW fees are used by UF. The University itemizes fees to an extent, but it is unclear how the collected money is actually spent. The correlation between fee increases and budget cuts would seem to indicate that fees aren’t really spent on what UF claims they are spent on, but are simply used as a revenue stream to make up for lost state funds!

To make matters worse, there is very little transparency about HOW fees are used by UF. The University itemizes fees to an extent, but it is unclear how the collected money is actually spent. The correlation between fee increases and budget cuts would seem to indicate that fees aren’t really spent on what UF claims they are spent on, but are simply used as a revenue stream to make up for lost state funds!

Fee Relief

GAU has fought for and won fee relief in recent contracts. As a result, the University will now pay nearly a third of non-tuition student fees. As of Spring 2021, a graduate employee enrolled in nine credit hours will see a savings of $227 a semester! The average graduate employee taking eighteen credit hours a year will keep $455 more of their paycheck each year. Those enrolled in twenty-four credit hours will keep $606 more of their paycheck! This means that graduate employees can expect to save approximately $910 to $1,212 over the course of a two-year degree, and $2,275 to $3,030 over the course of a five-year degree! And this fee relief does not affect the availability of any services offered by the University or others.

This fee relief is money in addition to raises that helps graduate employees deal with the burden that fees place on their finances. While this money does not cover the full cost of fees, our fight is not over. Each year we fight for increasing relief for fees. We believe it is wrong for graduate employees to be forced to pay-to-work at UF and universities across Florida. since many of the fees are mandated by the state of Florida, we are fighting for legislation that decreases fees for graduate students state-wide, On both of these fronts, we need your help and involvement! Join us as we move forward.

This fee relief is money in addition to raises that helps graduate employees deal with the burden that fees place on their finances. While this money does not cover the full cost of fees, our fight is not over. Each year we fight for increasing relief for fees. We believe it is wrong for graduate employees to be forced to pay-to-work at UF and universities across Florida. since many of the fees are mandated by the state of Florida, we are fighting for legislation that decreases fees for graduate students state-wide, On both of these fronts, we need your help and involvement! Join us as we move forward.

Frequently Asked Questions on Fee Relief Payments

How is fee relief paid?

The University of Florida, through the Bursar, will disburse fee relief either through one (1) lump sum payment during the semester, or spread the total amount of fee relief out through your paychecks for that semester.

When is fee relief paid?

Depending upon the method of disbursal chosen by the University of Florida, fee relief payments may be made at different times during the semester. Lump sum payments are typically made toward the middle or end of the semester. If the total amount of fee relief is spread across your paychecks for that semester, those payments may not appear in your first or second paycheck for that semester. Remember that as a graduate employee, your deadline for paying student fees is later than other students.

How much per credit hour is fee relief?

As of the Spring 2021 semester, fee relief is equivalent to $25.25 per credit hour. Fee relief encompasses the transportation ($9.44) and health fees ($15.81). If these fees increase, fee relief will increase as well.

Remote students may receive less fee relief if they are not charged the transportation or health fees.

Remote students may receive less fee relief if they are not charged the transportation or health fees.

NOTE: If you are taking an on-line course or are a remote student, the fee calculator may not accurately reflect your amount of student fees.

Do all graduate students receive fee relief?

While only graduate employees represented by GAU receive fee relief, we continue to fight for lower non-tuition student fees for all students.

Are fee relief payments taxable?

Fee relief payments are subject to federal tax withholdings. Specifically, fee relief is taxed as financial aid and the payment is reported to the Internal Revenue Service on your 1098-T, which includes qualified tuition and fees payments.

Fee DeadlinesIn our collective bargaining agreement, GAU has won fee deferral, allowing graduate employees to pay their non-tuition student fees later in the semester.

For graduate employees, student fees are due no earlier than on the following dates each semester:

The University may impose later fee deadlines. |